Page 234 - 2021 Annual Report

P. 234

Kilas Kinerja

Performance

Highlight

The original financial statements included herein are in

Indonesian language.

PT KILANG PERTAMINA BALIKPAPAN PT KILANG PERTAMINA BALIKPAPAN

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2021 As of December 31, 2021

(Disajikan dalam US Dollar, (Expressed in US Dollar,

kecuali dinyatakan lain) unless otherwise stated)

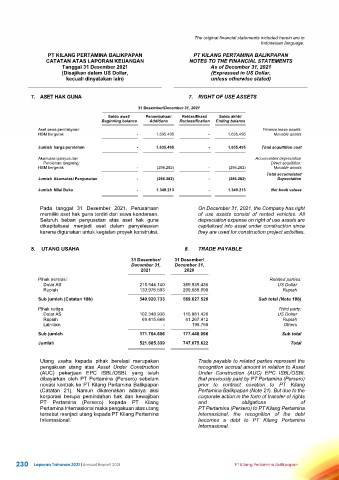

7. ASET HAK GUNA 7. RIGHT OF USE ASSETS

31 Desember/December 31, 2021

Saldo awal/ Penambahan/ Reklasifikasi/ Saldo akhir/

Beginning balance Additions Reclassification Ending balance

Aset sewa pembiayaan: Finance lease assets:

HBM bergerak - 1.635.495 - 1.635.495 Movable assets

Jumlah harga perolehan - 1.635.495 - 1.635.495 Total acquitition cost

Akumulasi penyusutan Accumulated depreciation

Perolehan langsung: Direct acquitition:

HBM bergerak - (286.282) - (286.282) Movable assets

Total accumulated

Jumlah Akumulasi Penyusutan - (286.282) - (286.282) Depreciation

Jumlah Nilai Buku - 1.349.213 - 1.349.213 Net book values

Pada tanggal 31 Desember 2021, Perusahaan On December 31, 2021, the Company has right

memiliki aset hak guna terdiri dari sewa kendaraan. of use assets consist of rented vehicles. All

Seluruh beban penyusutan atas aset hak guna depreciation expense on right of use assets are

dikapitalisasi menjadi aset dalam penyelesaian capitalized into asset under construction since

karena digunakan untuk kegiatan proyek konstruksi. they are used for construction project activities.

8. UTANG USAHA 8. TRADE PAYABLE

31 Desember/ 31 Desember/

December 31, December 31,

2021 2020

Pihak berelasi: Related parties:

Dolar AS 215.944.140 359.939.436 US Dollar

Rupiah 133.976.593 209.688.090 Rupiah

Sub jumlah (Catatan 18b) 349.920.733 569.627.526 Sub total (Note 18b)

Pihak ketiga: Third party:

Dolar AS 102.348.938 115.981.426 US Dollar

Rupiah 69.415.668 61.267.912 Rupiah

Lain-lain - 198.758 Others

Sub jumlah 171.764.606 177.448.096 Sub total

Jumlah 521.685.339 747.075.622 Total

Utang usaha kepada pihak berelasi merupakan Trade payable to related parties represent the

pengakuan utang atas Asset Under Construction recognition accrual amount in relation to Asset

(AUC) pekerjaan EPC ISBL/OSBL yang telah Under Construction (AUC) EPC ISBL/OSBL

dibayarkan oleh PT Pertamina (Persero) sebelum that previously paid by PT Pertamina (Persero)

novasi kontrak ke PT Kilang Pertamina Balikpapan prior to contract novation to PT Kilang

(Catatan 21). Namun dikarenakan adanya aksi Pertamina Balikpapan (Note 21). But due to the

korporasi berupa pemindahan hak dan kewajiban corporate action in the form of transfer of rights

PT Pertamina (Persero) kepada PT Kilang and obligations of

Pertamina Internasional maka pengakuan atas utang PT Pertamina (Persero) to PT Kilang Pertamina

tersebut menjadi utang kepada PT Kilang Pertamina Internasional, the recognition of the debt

Internasional. becomes a debt to PT Kilang Pertamina

Internasional.

34

230 Laporan Tahunan 2021 | Annual Report 2021 PT Kilang Pertamina Balikpapan