Page 232 - 2021 Annual Report

P. 232

Kilas Kinerja

Performance

Highlight

The original financial statements included herein are in

Indonesian language.

PT KILANG PERTAMINA BALIKPAPAN PT KILANG PERTAMINA BALIKPAPAN

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2021 As of December 31, 2021

(Disajikan dalam US Dollar, (Expressed in US Dollar,

kecuali dinyatakan lain) unless otherwise stated)

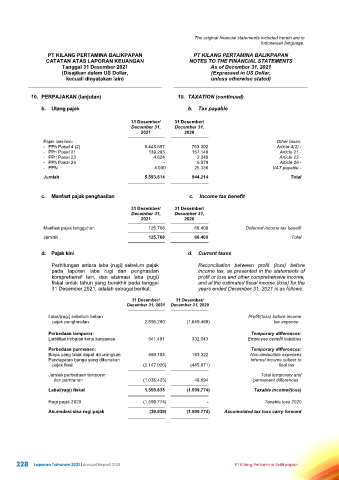

10. PERPAJAKAN (lanjutan) 10. TAXATION (continued)

b. Utang pajak b. Tax payable

31 Desember/ 31 Desember/

December 31, December 31,

2021 2020

Pajak lain-lain: Other taxes:

- PPh Pasal 4 (2) 5.445.697 753.302 Article 4(2) -

- PPh Pasal 21 139.293 157.148 Article 21 -

- PPh Pasal 23 4.624 2.349 Article 23 -

- PPh Pasal 26 - 6.079 Article 26 -

- PPN 4.000 25.336 VAT payable -

Jumlah 5.593.614 944.214 Total

c. Manfaat pajak penghasilan c. Income tax benefit

31 Desember/ 31 Desember/

December 31, December 31,

2021 2020

Manfaat pajak tangguhan 125.768 66.409 Deferred income tax benefit

Jumlah 125.768 66.409 Total

d. Pajak kini d. Current taxes

Perhitungan antara laba (rugi) sebelum pajak Reconciliation between profit (loss) before

pada laporan laba rugi dan penghasilan income tax, as presented in the statements of

komprehensif lain, dan etsimasi laba (rugi) profit or loss and other comprehensive income,

fiskal untuk tahun yang berakhir pada tanggal and at the estimated fiscal income (loss) for the

31 Desember 2021, adalah sebagai berikut: years ended December 31, 2021 is as follows:

31 Desember/ 31 Desember/

December 31, 2021 December 31, 2020

Laba/(rugi) sebelum beban Profit/(loss) before income

pajak penghasilan 2.596.260 (1.649.468) tax expense

Perbedaan temporer: Temporary differences:

Liabilitas imbalan kerja karyawan 541.491 332.043 Employee benefit liabilities

Perbedaan permanen: Temporary differences:

Biaya yang tidak dapat dikurangkan 569.104 163.322 Non-deductible expenses

Pendapatan bunga yang dikenakan Interest income subect to

pajak final (2.147.020) (445.671) final tax

Jumlah perbedaan temporer Total temporary and

dan permanen (1.036.425) 49.694 permanent differences

Laba/(rugi) fiskal 1.559.835 (1.599.774) Taxable income/(loss)

Rugi pajak 2020 (1.599.774) - Taxable loss 2020

Akumulasi sisa rugi pajak (39.939) (1.599.774) Accumulated tax loss carry forward

36

228 Laporan Tahunan 2021 | Annual Report 2021 PT Kilang Pertamina Balikpapan