Page 230 - 2021 Annual Report

P. 230

Kilas Kinerja

Performance

Highlight

The original financial statements included herein are in

Indonesian language.

PT KILANG PERTAMINA BALIKPAPAN PT KILANG PERTAMINA BALIKPAPAN

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2021 As of December 31, 2021

(Disajikan dalam US Dollar, (Expressed in US Dollar,

kecuali dinyatakan lain) unless otherwise stated)

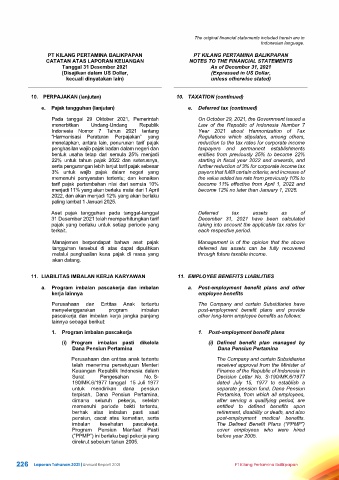

10. PERPAJAKAN (lanjutan) 10. TAXATION (continued)

e. Pajak tangguhan (lanjutan) e. Deferred tax (continued)

Pada tanggal 29 Oktober 2021, Pemerintah On October 29, 2021, the Government issued a

menerbitkan Undang-Undang Republik Law of the Republic of Indonesia Number 7

Indonesia Nomor 7 Tahun 2021 tentang Year 2021 about Harmonization of Tax

“Harmonisasi Peraturan Perpajakan” yang Regulations which stipulates, among others,

menetapkan, antara lain, penurunan tarif pajak reduction to the tax rates for corporate income

penghasilan wajib pajak badan dalam negeri dan taxpayers and permanent establishments

bentuk usaha tetap dari semula 25% menjadi entities from previously 25% to become 22%

22% untuk tahun pajak 2022 dan seterusnya, starting in fiscal year 2022 and onwards, and

serta pengurangan lebih lanjut tarif pajak sebesar further reduction of 3% for corporate income tax

3% untuk wajib pajak dalam negeri yang payers that fulfill certain criteria; and increase of

memenuhi persyaratan tertentu; dan kenaikan the value added tax rate from previously 10% to

tarif pajak pertambahan nilai dari semula 10% become 11% effective from April 1, 2022 and

menjadi 11% yang akan berlaku mulai dari 1 April become 12% no later than January 1, 2025.

2022, dan akan menjadi 12% yang akan berlaku

paling lambat 1 Januari 2025.

Aset pajak tangguhan pada tanggal-tanggal Deferred tax assets as of

31 Desember 2021 telah memperhitungkan tarif December 31, 2021 have been calculated

pajak yang berlaku untuk setiap periode yang taking into account the applicable tax rates for

terkait. each respective period.

Manajemen berpendapat bahwa aset pajak Management is of the opinion that the above

tangguhan tersebut di atas dapat dipulihkan deferred tax assets can be fully recovered

melalui penghasilan kena pajak di masa yang through future taxable income.

akan datang.

11. LIABILITAS IMBALAN KERJA KARYAWAN 11. EMPLOYEE BENEFITS LIABILITIES

a. Program imbalan pascakerja dan imbalan a. Post-employment benefit plans and other

kerja lainnya employee benefits

Perusahaan dan Entitas Anak tertentu The Company and certain Subsidiaries have

menyelenggarakan program imbalan post-employment benefit plans and provide

pascakerja dan imbalan kerja jangka panjang other long-term employee benefits as follows:

lainnya sebagai berikut:

1. Program imbalan pascakerja 1. Post-employment benefit plans

(i) Program imbalan pasti dikelola (i) Defined benefit plan managed by

Dana Pensiun Pertamina Dana Pensiun Pertamina

Perusahaan dan entitas anak tertentu The Company and certain Subsidiaries

telah menerima persetujuan Menteri received approval from the Minister of

Keuangan Republik Indonesia dalam Finance of the Republic of Indonesia in

Surat Pengesahan No. S- Decision Letter No. S-190/MK.6/1977

190/MK.6/1977 tanggal 15 Juli 1977 dated July 15, 1977 to establish a

untuk mendirikan dana pensiun separate pension fund, Dana Pensiun

terpisah, Dana Pensiun Pertamina, Pertamina, from which all employees,

dimana seluruh pekerja, setelah after serving a qualifying period, are

memenuhi periode bakti tertentu, entitled to defined benefits upon

berhak atas imbalan pasti saat retirement, disability or death, and also

pensiun, cacat atau kematian, serta post-employment medical benefits.

imbalan kesehatan pascakerja. The Defined Benefit Plans (“PPMP”)

Program Pensiun Manfaat Pasti cover employees who were hired

(”PPMP”) ini berlaku bagi pekerja yang before year 2005.

direkrut sebelum tahun 2005.

38

226 Laporan Tahunan 2021 | Annual Report 2021 PT Kilang Pertamina Balikpapan