Page 151 - 2020 Annual Report

P. 151

The original financial statements included herein are in

Indonesian language.

PT KILANG PERTAMINA BALIKPAPAN PT KILANG PERTAMINA BALIKPAPAN

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2020 As of December 31, 2020

(Disajikan dalam US Dollar, (Expressed in US Dollar,

kecuali dinyatakan lain) unless otherwise stated)

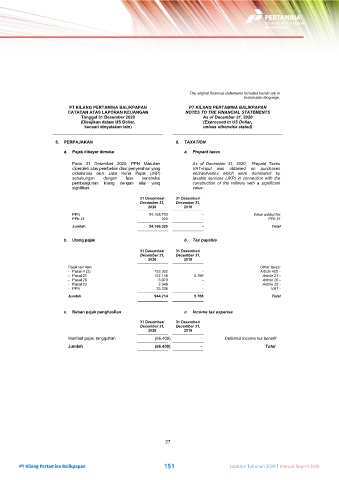

8. PERPAJAKAN 8. TAXATION

a. Pajak dibayar dimuka a. Prepaid taxes

Pada 31 Desember 2020, PPN Masukan As of December 31, 2020, Prepaid Taxes

diperoleh atas pembelian dan/ penyerahan yang VAT-Input was obtained on purchases

didominasi oleh Jasa Kena Pajak (JKP) and/deliveries which were dominated by

sehubungan dengan fase konstruksi taxable services (JKP) in connection with the

pembangunan kilang dengan nilai yang construction of the refinery with a significant

signifikan. value.

31 Desember/ 31 Desember/

December 31, December 31,

2020 2019

PPN 54.165.700 - Value added tax

PPh 21 325 - PPh 21

Jumlah 54.166.025 - Total

b. Utang pajak b. Tax payable

31 Desember/ 31 Desember/

December 31, December 31,

2020 2019

Pajak lain-lain: Other taxes:

- Pasal 4 (2) 753.302 - Article 4(2) -

- Pasal 21 157.148 5.766 Article 21 -

- Pasal 26 6.079 - Article 26 -

- Pasal 23 2.349 - Article 23 -

- PPN 25.336 - VAT -

Jumlah 944.214 5.766 Total

c. Beban pajak penghasilan c. Income tax expense

31 Desember/ 31 Desember/

December 31, December 31,

2020 2019

Manfaat pajak tangguhan (66.409) - Deferred income tax benefit

Jumlah (66.409) - Total

27

PT Kilang Pertamina Balikpapan 151 Laporan Tahunan 2020 | Annual Report 2020