Page 278 - PT Kilang Pertamina Balikpapan

P. 278

273

The original financial statements included herein are in

Indonesian language.

PT KILANG PERTAMINA BALIKPAPAN PT KILANG PERTAMINA BALIKPAPAN

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2022 As of December 31, 2022

(Disajikan dalam dolar Amerika Serikat, (Expressed in US dollar,

kecuali dinyatakan lain) unless otherwise stated)

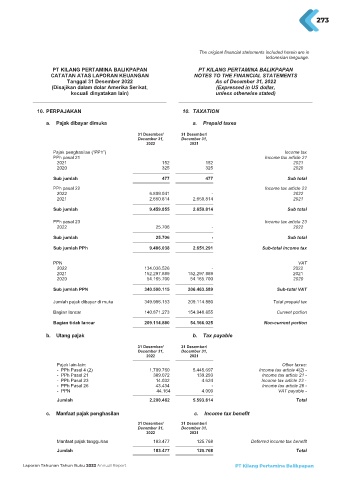

10. PERPAJAKAN 10. TAXATION

a. Pajak dibayar dimuka a. Prepaid taxes

31 Desember/ 31 Desember/

December 31, December 31,

2022 2021

Pajak penghasilan (“PPh”) Income tax

PPh pasal 21 Income tax article 21

2021 152 152 2021

2020 325 325 2020

Sub jumlah 477 477 Sub total

PPh pasal 22 Income tax article 22

2022 6.809.041 - 2022

2021 2.650.814 2.650.814 2021

Sub jumlah 9.459.855 2.650.814 Sub total

PPh pasal 23 Income tax article 23

2022 25.706 - 2022

Sub jumlah 25.706 - Sub total

Sub jumlah PPh 9.486.038 2.651.291 Sub-total income tax

PPN VAT

2022 134.036.526 - 2022

2021 152.297.889 152.297.889 2021

2020 54.165.700 54.165.700 2020

Sub jumlah PPN 340.500.115 206.463.589 Sub-total VAT

Jumlah pajak dibayar di muka 349.986.153 209.114.880 Total prepaid tax

Bagian lancar 140.871.273 154.948.855 Current portion

Bagian tidak lancar 209.114.880 54.166.025 Non-current portion

b. Utang pajak b. Tax payable

31 Desember/ 31 Desember/

December 31, December 31,

2022 2021

Pajak lain-lain: Other taxes:

- PPh Pasal 4 (2) 1.709.760 5.445.697 Income tax article 4(2) -

- PPh Pasal 21 389.072 139.293 Income tax article 21 -

- PPh Pasal 23 14.032 4.624 Income tax article 23 -

- PPh Pasal 26 43.434 - Income tax article 26 -

- PPN 44.164 4.000 VAT payable -

Jumlah 2.200.462 5.593.614 Total

c. Manfaat pajak penghasilan c. Income tax benefit

31 Desember/ 31 Desember/

December 31, December 31,

2022 2021

Manfaat pajak tangguhan 183.477 125.768 Deferred income tax benefit

Jumlah 183.477 125.768 Total

Laporan Tahunan Tahun Buku 2022 Annual Report PT Kilang Pertamina Balikpapan

38