Page 291 - PT Kilang Pertamina Balikpapan

P. 291

286

The original financial statements included herein are in

Indonesian language.

PT KILANG PERTAMINA BALIKPAPAN PT KILANG PERTAMINA BALIKPAPAN

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2022 As of December 31, 2022

(Disajikan dalam dolar Amerika Serikat, (Expressed in US dollar,

kecuali dinyatakan lain) unless otherwise stated)

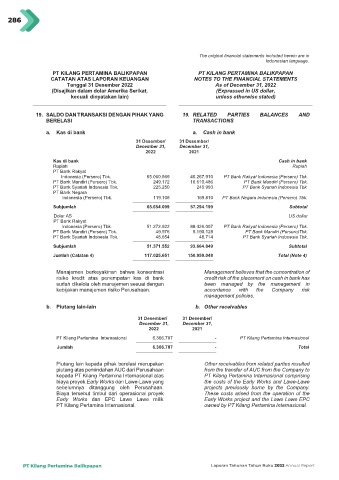

19. SALDO DAN TRANSAKSI DENGAN PIHAK YANG 19. RELATED PARTIES BALANCES AND

BERELASI TRANSACTIONS

a. Kas di bank a. Cash in bank

31 Desember/ 31 Desember/

December 31, December 31,

2022 2021

Kas di bank Cash in bank

Rupiah Rupiah

PT Bank Rakyat

Indonesia (Persero) Tbk. 65.060.569 40.267.910 PT Bank Rakyat Indonesia (Persero) Tbk.

PT Bank Mandiri (Persero) Tbk. 249.172 16.610.486 PT Bank Mandiri (Persero) Tbk.

PT Bank Syariah Indonesia Tbk. 225.250 245.993 PT Bank Syariah Indonesia Tbk

PT Bank Negara

Indonesia (Persero) Tbk. 119.108 169.810 PT Bank Negara Indonesia (Persero) Tbk.

Subjumlah 65.654.099 57.294.199 Subtotal

Dolar AS US dollar

PT Bank Rakyat

Indonesia (Persero) Tbk. 51.272.922 88.426.007 PT Bank Rakyat Indonesia (Persero) Tbk.

PT Bank Mandiri (Persero) Tbk. 49.976 5.190.128 PT Bank Mandiri (Persero)Tbk.

PT Bank Syariah Indonesia Tbk. 48.654 48.714 PT Bank Syariah Indonesia Tbk.

Subjumlah 51.371.552 93.664.849 Subtotal

Jumlah (Catatan 4) 117.025.651 150.959.048 Total (Note 4)

Manajemen berkeyakinan bahwa konsentrasi Management believes that the concentration of

risiko kredit atas penempatan kas di bank credit risk of the placement on cash in bank has

sudah dikelola oleh manajemen sesuai dengan been managed by the management in

kebijakan manajemen risiko Perusahaan. accordance with the Company risk

management policies.

b. Piutang lain-lain b. Other receivables

31 Desember/ 31 Desember/

December 31, December 31,

2022 2021

PT Kilang Pertamina Internasional 6.366.787 - PT Kilang Pertamina Internasional

Jumlah 6.366.787 - Total

Piutang lain kepada pihak berelasi merupakan Other receivables from related parties resulted

piutang atas pemindahan AUC dari Perusahaan from the transfer of AUC from the Company to

kepada PT Kilang Pertamina Internasional atas PT Kilang Pertamina Internasional comprising

biaya proyek Early Works dan Lawe-Lawe yang the costs of the Early Works and Lawe-Lawe

sebelumnya ditanggung oleh Perusahaan. projects previously borne by the Company.

Biaya tersebut timbul dari operasional proyek These costs arised from the operation of the

Early Works dan EPC Lawe Lawe milik Early Works project and the Lawe Lawe EPC

PT Kilang Pertamina Internasional. owned by PT Kilang Pertamina Internasional.

PT Kilang Pertamina Balikpapan Laporan Tahunan Tahun Buku 2022 Annual Report

51