Page 98 - 2021 Annual Report

P. 98

Kilas Kinerja Laporan Profil Analisis dan Pembahasan

Performance Manajemen Perusahaan Manajemen

Highlight Management Report Company Profile Management Discussion

and Analysis

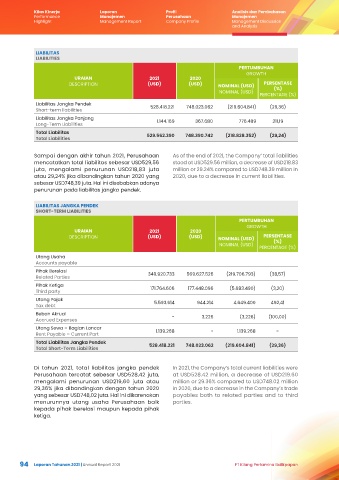

LIABILITAS

LIABILITIES

PERTUMBUHAN

GROWTH

URAIAN 2021 2020

DESCRIPTION (USD) (USD) PERSENTASE

NOMINAL (USD)

(%)

NOMINAL (USD)

PERCENTAGE (%)

Liabilitas Jangka Pendek

528.418.221 748.023.062 (219.604.841) (29,36)

Short-term liabilities

Liabilitas Jangka Panjang

1.144.169 367.680 776.489 211,19

Long-Term Liabilities

Total Liabilitas

529.562.390 748.390.742 (218.828.352) (29,24)

Total Liabilities

Sampai dengan akhir tahun 2021, Perusahaan As of the end of 2021, the Company’ total liabilities

mencatatkan total liabilitas sebesar USD529,56 stood at USD529.56 million, a decrease of USD218.83

juta, mengalami penurunan USD218,83 juta million or 29.24% compared to USD748.39 million in

atau 29,24% jika dibandingkan tahun 2020 yang 2020, due to a decrease in current liabilities.

sebesar USD748,39 juta. Hal ini disebabkan adanya

penurunan pada liabilitas jangka pendek.

LIABILITAS JANGKA PENDEK

SHORT-TERM LIABILITIES

PERTUMBUHAN

GROWTH

URAIAN 2021 2020

DESCRIPTION (USD) (USD) PERSENTASE

NOMINAL (USD)

(%)

NOMINAL (USD)

PERCENTAGE (%)

Utang Usaha

Accounts payable

Pihak Berelasi

349.920.733 569.627.526 (219.706.793) (38,57)

Related Parties

Pihak Ketiga

171.764.606 177.448.096 (5.683.490) (3,20)

Third party

Utang Pajak

5.593.614 944.214 4.649.400 492,41

Tax debt

Beban Akrual

- 3.226 (3.226) (100,00)

Accrued Expenses

Utang Sewa – Bagian Lancar

1.139.268 - 1.139.268 -

Rent Payable – Current Part

Total Liabilitas Jangka Pendek

528.418.221 748.023.062 (219.604.841) (29,36)

Total Short-Term Liabilities

Di tahun 2021, total liabilitas jangka pendek In 2021, the Company’s total current liabilities were

Perusahaan tercatat sebesar USD528,42 juta, at USD528.42 million, a decrease of USD219.60

mengalami penurunan USD219,60 juta atau million or 29.36% compared to USD748.02 million

29,36% jika dibandingkan dengan tahun 2020 in 2020, due to a decrease in the Company’s trade

yang sebesar USD748,02 juta. Hal ini dikarenakan payables both to related parties and to third

menurunnya utang usaha Perusahaan baik parties.

kepada pihak berelasi maupun kepada pihak

ketiga.

94 Laporan Tahunan 2021 | Annual Report 2021 PT Kilang Pertamina Balikpapan