Page 97 - 2021 Annual Report

P. 97

Tinjauan Pendukung Tata Kelola Perusahaan Tanggung Jawab Sosial

Bisnis Good Corporate dan Lingkungan

Business Support Governance Social and Environmental

Review Responsibility

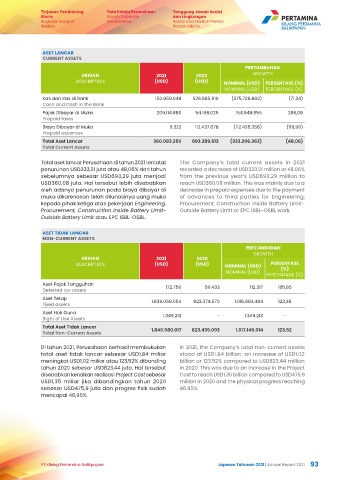

ASET LANCAR

CURRENT ASSETS

PERTUMBUHAN

GROWTH

URAIAN 2021 2020

DESCRIPTION (USD) (USD) NOMINAL (USD) PERSENTASE (%)

NOMINAL (USD) PERCENTAGE (%)

Kas dan Kas di Bank 150.959.048 526.685.910 (375.726.862) (71,34)

Cash and Cash in the Bank

Pajak Dibayar di Muka 209.114.880 54.166.025 154.948.855 286,06

Prepaid taxes

Biaya Dibayar di Muka 9.322 112.437.678 (112.428.356) (99,99)

Prepaid expenses

Total Aset Lancar 360.083.250 693.289.613 (333.206.363) (48,06)

Total Current Assets

Total aset lancar Perusahaan di tahun 2021 tercatat The Company’s total current assets in 2021

penurunan USD333,21 juta atau 48,06% dari tahun recorded a decrease of USD333.21 million or 48.06%

sebelumnya sebesar USD693,29 juta menjadi from the previous year’s USD693.29 million to

USD360,08 juta. Hal tersebut lebih disebabkan reach USD360.08 million. This was mainly due to a

oleh adanya penurunan pada biaya dibayar di decrease in prepaid expenses due to the payment

muka dikarenakan telah dilunasinya uang muka of advances to third parties for Engineering,

kepada pihak ketiga atas pekerjaan Engineering, Procurement, Construction Inside Battery Limit-

Procurement, Construction Inside Battery Limit- Outside Battery Limit or EPC ISBL-OSBL work.

Outside Battery Limit atau EPC ISBL-OSBL.

ASET TIDAK LANCAR

NON-CURRENT ASSETS

PERTUMBUHAN

GROWTH

URAIAN 2021 2020

DESCRIPTION (USD) (USD) PERSENTASE

NOMINAL (USD)

(%)

NOMINAL (USD)

PERCENTAGE (%)

Aset Pajak Tangguhan

172.750 60.433 112.317 185,85

Deferred tax assets

Aset Tetap

1.839.058.054 823.374.570 1.015.683.484 123,36

Fixed assets

Aset Hak Guna

1.349.213 - 1.349.213 -

Right of Use Assets

Total Aset Tidak Lancar

1.840.580.017 823.435.003 1.017.145.014 123,52

Total Non-Current Assets

Di tahun 2021, Perusahaan berhasil membukukan In 2021, the Company’s total non-current assets

total aset tidak lancar sebesar USD1,84 miliar stood at USD1.84 billion, an increase of USD1.02

meningkat USD1,02 miliar atau 123,52% dibanding billion or 123.52% compared to USD823.44 million

tahun 2020 sebesar USD823,44 juta. Hal tersebut in 2020. This was due to an increase in the Project

disebabkan kenaikan realisasi Project Cost sebesar Cost to reach USD1.35 billion compared to USD475.9

USD1,35 miliar jika dibandingkan tahun 2020 million in 2020 and the physical progress reaching

sebesar USD475,9 juta dan progres fisik sudah 46.95%.

mencapai 46,95%.

PT Kilang Pertamina Balikpapan Laporan Tahunan 2021 | Annual Report 2021 93