Page 106 - PT Kilang Pertamina Balikpapan

P. 106

101

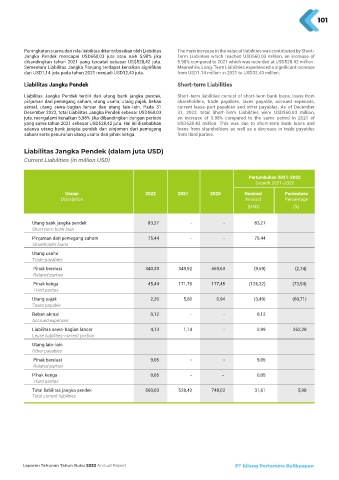

Peningkatan utama dari nilai liabilitas dikontribusikan oleh Liabilitas the main increase in the value of liabilities was contributed by short-

Jangka Pendek mencapai usD560,03 juta atau naik 5,98% jika term Liabilities which reached usD560.03 million, an increase of

dibandingkan tahun 2021 yang tercatat sebesar us$528,42 juta. 5.98% compared to 2021 which was recorded at usD528.42 million.

Sementara Liabilitas Jangka Panjang terdapat kenaikan signifikan Meanwhile, Long-Term Liabilities experienced a significant increase

dari usD1,14 juta pada tahun 2021 menjadi usD32,40 juta. from usD1.14 million in 2021 to usD32.40 million.

Liabilitas Jangka Pendek Short-term Liabilities

Liabilitas Jangka Pendek terdiri dari utang bank jangka pendek, short-term liabilities consist of short-term bank loans, loans from

pinjaman dari pemegang saham, utang usaha, utang pajak, beban shareholders, trade payables, taxes payable, accrued expenses,

akrual, utang sewa-bagian lancar dan utang lain-lain. Pada 31 current lease-part payables and other payables. as of December

Desember 2022, total Liabilitas Jangka Pendek sebesar usD560,03 31, 2022, total short-term Liabilities were usD560.03 million,

juta, mengalami kenaikan 5,98% jika dibandingkan dengan periode an increase of 5.98% compared to the same period in 2021 of

yang sama tahun 2021 sebesar usD528,42 juta. Hal ini disebabkan usD528.42 million. this was due to short-term bank loans and

adanya utang bank jangka pendek dan pinjaman dari pemegang loans from shareholders as well as a decrease in trade payables

saham serta penurunan utang usaha dari pihak ketiga. from third parties.

Liabilitas Jangka pendek (dalam juta uSd)

Current Liabilities (in million USD)

Pertumbuhan 2021-2022

Growth 2021-2022

Uraian 2022 2021 2020 Nominal Persentase

Discription Amount Percentage

(usD) (%)

Utang bank jangka pendek 83,27 - - 83,27

Short term bank loan

Pinjaman dari pemegang saham 75,44 - - 75,44

Shareholder loans

utang usaha

Trade payables

Pihak berelasi 340,33 349,92 569,63 (9,59) (2,74)

Related parties

Pihak ketiga 45,44 171,76 177,45 (126,32) (73,54)

Third parties

utang pajak 2,20 5,60 0,94 (3,40) (60,71)

Taxes payable

Beban akrual 0,12 - - 0,12

Accrued expenses

Liabilitas sewa-bagian lancar 4,13 1,14 - 2,99 262,28

Lease liabilities-current portion

utang lain-lain

Other payables

Pihak berelasi 9,05 - - 9,05

Related parties

Pihak ketiga 0,05 - - 0,05

Third parties

total liabilitas jangka pendek 560,03 528,42 748,02 31,61 5,98

Total current liabilities

Laporan Tahunan Tahun Buku 2022 Annual Report PT Kilang Pertamina Balikpapan